Recent studies have shown that the younger the generation, the less money there is going towards retirement savings. From the Swing generation (1928-1945) through Generation Y (late 1980s), there is less and less money being saved. And people are putting more faith in the Social Security benefits they are supposed to receive, even though reports indicate that the money will run out at some point in the near future. Studies also show that 96% of Americans will not have enough funds available to support them in retirement.

Our country has become inundated with instant gratification. Our commercials push the message “you NEED this” or “you are not worth much if you don’t have this product.” And we listen! Did you know that the average television commercial selling a product or service during prime time demonstrates a lifestyle that requires discretionary (after taxes, cost of living, and investments) of more than $200,000 per year?! According to a 2002 census bureau, the average income for a working household is less than $60,000. Advertisers are telling us that the average person can live a lifestyle over three times greater than they actually can. The part that is hard to face is that we listen to them. We start to believe we have to live this way or at least look like we can afford it. And we pile on the debt.

Not too long ago, I heard from someone that said she started to turn off the TV more often. Not just because she wanted to spend more time with the family or save on electricity. But she said that she found she could save more money by simply not watching the constant barrage of advertisements that made her feel guilty or gave her the impression that she really needed something that in all reality she would consider a “want.” You know, turning off the TV more often might be a good start to getting on the right track. Getting away from marketing ploys and instead developing better relationships with our families could be a wonderful thing for both our finances and personal lives.

It’s not too late to start making changes, to get out of debt and start saving and investing money. Yes, it might take some work to break old habits and form new ones. And it might be uncomfortable to go out with your old friends who have just bought into the latest fad and talk about it non-stop, while you skipped this one because your budget wouldn’t allow it and it was something you realized you didn’t actually need anyways. But the point is that there is hope, and there are ways to reverse the situation that has become commonplace in our country today. A good place to start is by talking to a Financial Life Coach. We are able to take a look at your life with you and offer help and advice to help get you out of debt and stay out. Like a coach that an athlete might have, we are here to point out things that you may have overlooked or offer you new ideas for dealing with certain situations. It is similar to telling you your golf swing is a little high, causing the ball to veer left. We help you make adjustments so that metaphorical swing is just right, and so you can be successful. It is definitely a good idea for you to consider a iMoneyCoach so that you can break the norm and become a person or family that is prepared for retirement, to pay for college, or to handle any financial situation that life throws at you.

Tags: get out of debt, retirement, savings

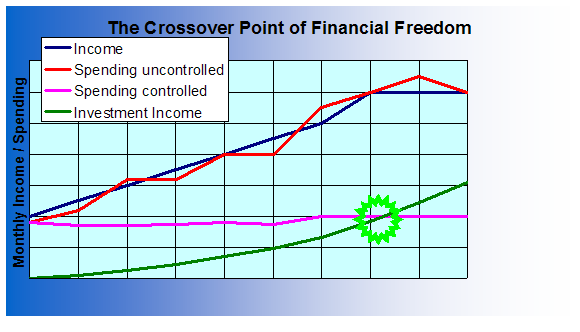

Here you can see a graph that deals with spending and income displayed by four different lines. Maybe it just looks like a boring old graph to you at first glance, but the possibilities it actually represents are incredible. The two lines (blue and red) that shoot heavily upward indicate an increase in income over time accompanied by an increase in spending. If we don’t have a controlled budget, we will end up spending any money we make. The more we make, the more we spend. This is almost a certainty in our country today, even though we all know we should be saving. However, if we were to maintain a budget, our spending level should not increase, even when we have more income. Note the stable pink line on the graph. In this scenario, we are able to budget money that comes from our growing income and put it towards investments and savings accounts. We do this by keeping the spending level stable. After a while, the interest generated from our investment accounts (green line) can actually become greater than the spending level (note the green circle). This is what we call HomeFree. You are no longer in debt, and you are actually making more money from your investments than you are spending. You also still have that blue income line which is still increasing, so you have even more to put back into your investments.

Can you imagine being in this place? Does it seem possible? For many people, this graph illustrates a pipe dream they think they could never reach. They think it’s just playing with numbers and lines but couldn’t possibly be reflected in their real lives. And as a result they don’t even try. In fact, many slip further and further into debt. But what you need to realize is that this is not some impossible dream. It is something that you CAN accomplish. We honestly want to help get people to this place and believe that it can be done. I have seen it happen many times.

While it looks on the surface like it’s just all about the money, there is really so much more to it than that. Being able to follow a budget and get money into savings involves taking consideration all the various parts of your life (the spiritual, personal, relational, occupational and financial) so that you can see how they tie together and how they affect or are affected by money. It’s eeasy to write up a budget or read books about saving, but then you have to go out and live life. Knowing how life affects and is affected by money is the first step to take on your journey. Only then can you really start making lasting changes that will get you to HomeFree. That’s why we have created iMoneyCoach, to help people take a look at their lives, everything in them, and see how they can become successful with their finances and leave a legacy for their families.

Tags: budget, financial freedom, homefree, savings, spending

Goals are often viewed as the end of a journey. We set goals and work to achieve them, and that’s the end of it, right?? No! Goals are a small part of the big picture. They are a living, changing thing that evolves with us as we move toward a bigger picture.

It is important to start with the big picture. Where do you want to be in 10 years? 20 years? You may have a dream of being wealthy enough that you can start your own charitable organization and dole out funds each month, helping millions. But you can’t get there in one day. And it is possible that you will never get to that point, but this big picture will keep you focused. Maybe you end up being able to donate enough to charity to help thousands. That is still a wonderful, big thing. It is this big picture you keep in mind along the way. It is your driving force and what helps you form your goals and make decisions.

Once you have that big picture in mind, you start on the road to it by setting goals. Goals are based on your personal values and needs. You need to set goals that have 4 qualities: specific, realistic, measurable, and motivational. It is a good idea to set your goals in 90 day increments. This way it is a long enough time to actually achieve something and see results, but it is not so far out that you lose sight of it and let it fall away (it is better than those oft forgotten New Year’s Resolutions). You can start with the little things that will help you get to your big picture. Say your big picture is paying for your kids’ college tuition. You can start by setting a goal of researching college savings plans first. Then in the next 90 days you will get a plan set up. Then you will make a goal to deposit a certain amount into the account. Further down the road, a goal of yours is to use some of your extra income to put more money into that account. After a while you will find yourself getting closer and closer to that dream. And keeping it in mind will help you make the little decisions along the way. Do we really need to eat out again tonight or can I cook a less expensive meal so that I have enough to go into the college savings account this month? Goals will keep you on track and help you put one foot in front of the other to get to that big picture.

Maybe you don’t have a big dream right now. Start now by letting your imagination run free. Remember when you could do that as a kid and come up with all sorts of ideas of things you wanted to do? Nothing was impossible. You can still do that today. It may be a little more difficult, but start thinking about what would make you happy and give you a fulfilled life.

Tags: goal setting, goals

Everybody gets angry at some point or another. However, there are ways we can process our anger in a productive manner. Here are five steps for moving from anger to positive, loving action.

1. Consciously acknowledge to yourself that you are angry.

Say the words out loud. “I am angry about this! Now what am I going to do?” Such a statement makes you aware of your own anger and also helps you recognize both your anger and the action you are going to take. You have set the stage for applying reason to your anger.

2. Restrain your immediate response.

Avoid the common but destructive responses: verbal or physical venting, or their opposite, withdrawal and silence.

3. Locate the focus of your anger.

What words or actions by the other person have made you experience anger? Whatever the cause of your anger, locate it. If the person has truly wronged you, identify the person’s sin. How has he or she wronged you? Then determine the seriousness of the offense. Some wrongs are minor, and some are major. Knowing its seriousness should affect your response.

4. Analyze your options.

The response should be positive and loving. The two most constructive options are to lovingly confront the person or to consciously decide to overlook the matter.

5. Take constructive action.

If you choose to “let the offense go,” then express this decision to God. Confess your anger and your willingness to turn the person over to the righteous and just God. Then release your anger to Him. If you choose to lovingly confront the person who has wronged you, do so gently. Listen to any explanation; it can give you a different perspective on the person’s actions and intentions. If the person admits that what he or she did was wrong and asks you to forgive, do so.

Tags: anger, conflict resolution

Whether we like to admit it or not, every single part of our lives affect or are affected by our finances. We cannot take “finances” and lump it into its own separate compartment in our lives, which unfortunately for many means that the books and tapes and seminars out there will not help them because those solutions focus on the one compartment. When people go back out into the world and live, they are frustrated to find that those solutions haven’t really solved anything.

Think about the day you had today or yesterday and all the ways that your life affected your finances, or ways your finances affected your life. You woke up and started the day by heading to the local coffee shop for your daily latte. You then headed on over to work because you need to make money to pay your bills. At the end of the day you got chewed out by your boss over a big misunderstanding, so when you got home you were tired and wanted to relax. So you took your spouse to the movies after dinner, where you had ordered an extra dessert, because you deserved dessert after the day you had. Then you drove back home in the car you are still paying off. And because it is chilly outside, when you got home you turned up the heat and snuggled into bed in your favorite flannel pajamas. Each and every thing described here is in one way or another tied to your finances. Say you cut out the daily $3 latte and think, “well, that just won’t affect my finances anymore.” But what if the latte was your way to reward yourself for getting out of bed in the morning and going to work? Now do you find a way to create a new reward, or does your work end up suffering and you miss out on a promotion?

Whether it is this or that, all the parts of our lives affect us financially, and our finances affect all parts of our lives. It is important to realize how they are intertwined so you can best determine how to move forward with your life, and how you can get your finances in order. It is a good idea to consult a Financial Life Coach to help you with this process, to show you how to identify these things in your life and how to deal with them appropriately. A Coach can help you gain understanding and learn how to manage your finances as well as work with the circumstances in your life that affect them so that you are not in a constant struggle and can actually get to the place where you can say “I love my life!”

Tags: affect, finances, financial life coach

![Validate my RSS feed [Valid RSS]](images/valid-rss-rogers.png)