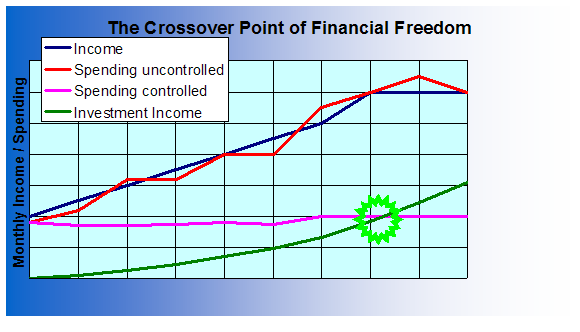

Here you can see a graph that deals with spending and income displayed by four different lines. Maybe it just looks like a boring old graph to you at first glance, but the possibilities it actually represents are incredible. The two lines (blue and red) that shoot heavily upward indicate an increase in income over time accompanied by an increase in spending. If we don’t have a controlled budget, we will end up spending any money we make. The more we make, the more we spend. This is almost a certainty in our country today, even though we all know we should be saving. However, if we were to maintain a budget, our spending level should not increase, even when we have more income. Note the stable pink line on the graph. In this scenario, we are able to budget money that comes from our growing income and put it towards investments and savings accounts. We do this by keeping the spending level stable. After a while, the interest generated from our investment accounts (green line) can actually become greater than the spending level (note the green circle). This is what we call HomeFree. You are no longer in debt, and you are actually making more money from your investments than you are spending. You also still have that blue income line which is still increasing, so you have even more to put back into your investments.

Can you imagine being in this place? Does it seem possible? For many people, this graph illustrates a pipe dream they think they could never reach. They think it’s just playing with numbers and lines but couldn’t possibly be reflected in their real lives. And as a result they don’t even try. In fact, many slip further and further into debt. But what you need to realize is that this is not some impossible dream. It is something that you CAN accomplish. We honestly want to help get people to this place and believe that it can be done. I have seen it happen many times.

While it looks on the surface like it’s just all about the money, there is really so much more to it than that. Being able to follow a budget and get money into savings involves taking consideration all the various parts of your life (the spiritual, personal, relational, occupational and financial) so that you can see how they tie together and how they affect or are affected by money. It’s eeasy to write up a budget or read books about saving, but then you have to go out and live life. Knowing how life affects and is affected by money is the first step to take on your journey. Only then can you really start making lasting changes that will get you to HomeFree. That’s why we have created iMoneyCoach, to help people take a look at their lives, everything in them, and see how they can become successful with their finances and leave a legacy for their families.

Tags: budget, financial freedom, homefree, savings, spending

![Validate my RSS feed [Valid RSS]](images/valid-rss-rogers.png)